I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from New Era Helium, Inc. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from New Era Helium, Inc.

Helium – A Key Enabler for Critical Industries and Applications

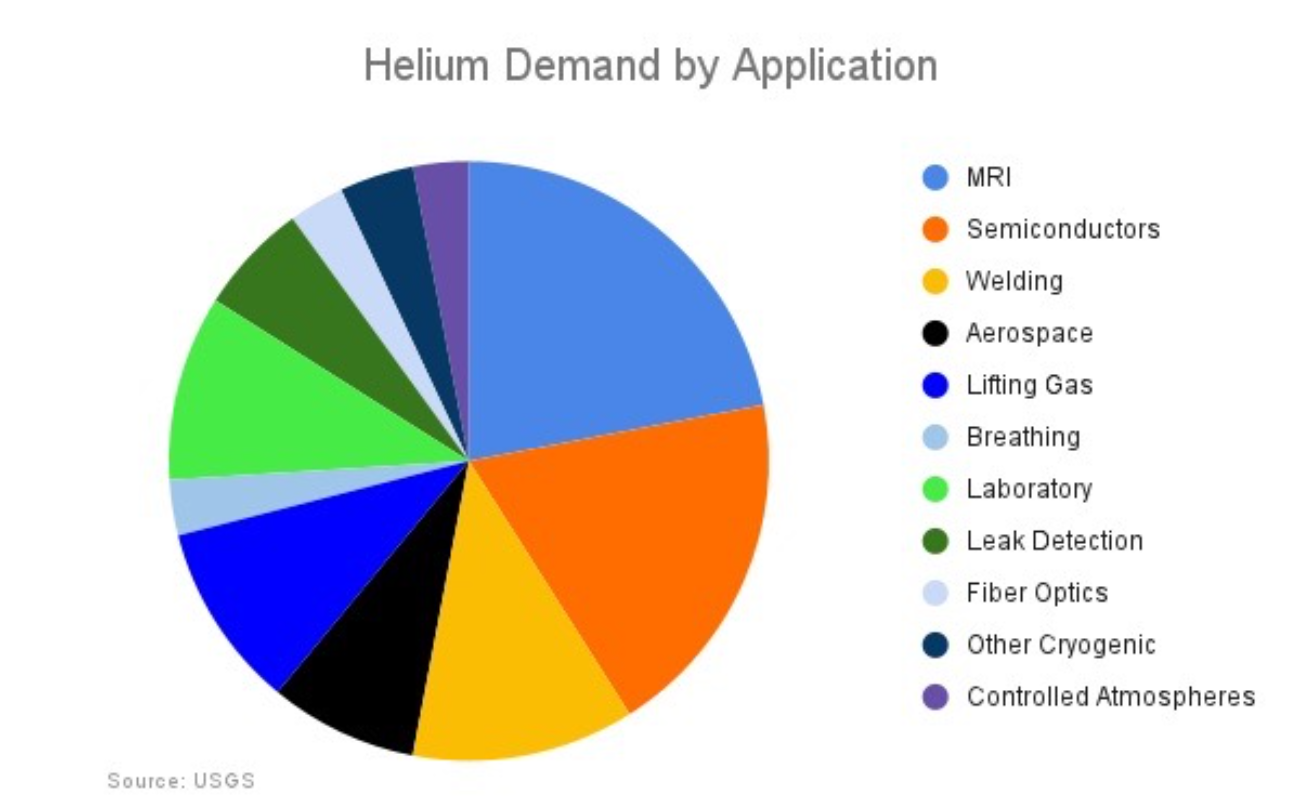

Helium is a critical element used in many important industries including semiconductor manufacturing, MRI imaging and aerospace. Increased demand for advanced semiconductor chips, driven by explosive growth in artificial intelligence (AI), as well as an expected increase in the number of rocket launches, will likely drive increased demand for helium in the coming years.

The situation has been further complicated by the recent emergence of Russia as a major helium supplier, the imposition of trade sanctions and hostilities in the Middle East that complicate logistics and threaten the reliability of supply.

Amidst this backdrop of geopolitical risk and strategic necessity, New Era Helium is committed to contributing reliable new domestic supply through the development of its Pecos Slope plant in New Mexico. Our aim is to bolster the North American Helium Market by harnessing commercially viable and politically secure helium reserves from legacy gas fields in the southwestern United States.

Key Helium Facts:

- Liquid helium, the coldest substance on Earth, is vital for cooling superconducting magnets that are critical to the operation of MRI scanners, nuclear fusion research and particle accelerators used for physics research.

- Semiconductor chip manufacturing, which will replace MRI as the leading helium application, requires large quantities of helium as a carrier gas, as well as for cooling wafers during the manufacturing process.

- The AI-driven surge in chip demand and the reshoring of wafer fabs will be catalysts for significant growth in U.S. helium demand.

- Helium is shipped around the world in liquid form in costly cryogenic containers to minimize the cost of transportation and to support certain key applications that require the extreme cold of liquid helium.

- The world’s supply depends primarily on just four countries—the US, Qatar, Russia and Algeria—and only 17 sources of bulk liquid helium worldwide.

- With so few sources, the helium market is particularly fragile and sensitive to disruptions—if a major plant goes offline, or a geopolitical event disrupts supply, helium may suddenly be in short supply. The world has experienced four periods of extended shortages of helium supply since 2006, with Helium Shortage 4.0 recently coming to an end by late 2023 after 2 years of supply deficit.

- Driven by shortages, the price of helium (at the source) increased at the compounded annual rate of 11.3% per year between 2006 and 2023.